What new features should a fintech be interested in?

Asked on 2024-08-01

1 search

A fintech company should be particularly interested in the following new features presented at WWDC:

-

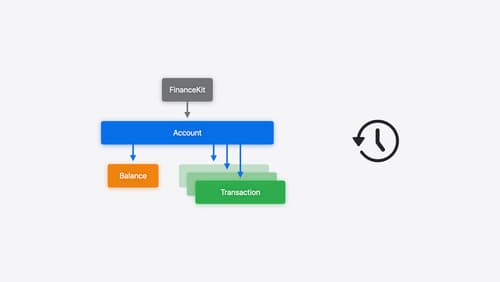

FinanceKit:

- Access to Financial Data: FinanceKit provides APIs to access a central repository of financial data stored in Apple Wallet. This includes high-level details for each account, balance information, and transaction history. This data is local on the device and does not require internet access (Meet FinanceKit).

- Query APIs: These APIs allow for both long-running and snapshot queries of financial data. They are asynchronous and require user consent, ensuring privacy (Meet FinanceKit).

- Transaction Picker: This feature allows users to select specific financial data to share, providing a balance between data access and user privacy (Meet FinanceKit).

-

Privacy Enhancements:

- Ongoing Access Control: When requesting access to financial data, users can choose which accounts to share and set the earliest sharing date, adding an extra layer of privacy (What’s new in privacy).

-

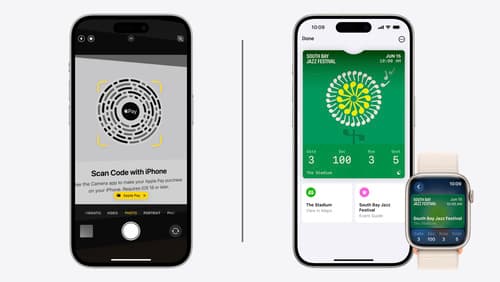

Apple Pay Enhancements:

- Apple Pay on the Web: With iOS 18, Apple Pay can now be used on any non-Safari browser by scanning a code with an iPhone, improving conversion performance and extending the user experience (What’s new in Wallet and Apple Pay).

-

App Store Connect:

- App Analytics Reports: New reports are available through the App Store Connect API, providing data on app engagement, downloads, sales, and usage. This can help fintech apps identify opportunities for improvement (What’s new in App Store Connect).

Relevant Sessions:

- Meet FinanceKit

- What’s new in privacy

- What’s new in Wallet and Apple Pay

- What’s new in App Store Connect

These features and enhancements can help fintech companies build more secure, private, and user-friendly financial applications.

Meet FinanceKit

Learn how FinanceKit lets your financial management apps seamlessly and securely share on-device data from Apple Cash, Apple Card, and more, with user consent and control. Find out how to request one-time and ongoing access to accounts, transactions, and balances — and how to build great experiences for iOS and iPadOS.

What’s new in App Store Connect

Explore new features for discovery, testing, and marketing. Find out how to nominate your apps for featuring on the App Store, share exciting moments (like a version launch) with marketing assets generated for you, deep link to specific content in your app from custom product pages, use the latest enhancements to TestFlight, and more.

What’s new in Wallet and Apple Pay

Take passes and payments to the next level with new enhancements to Wallet and Apple Pay. Make your event tickets shine with rich pass designs in Wallet, and bring great Apple Pay experiences to even more people with third-party browser support. We’ll also look at how to disburse funds with Apple Pay on the Web and highlight new API changes that help you integrate Apple Pay into even more purchasing flows.